Minnesota Mileage Reimbursement 2025. Charitable rate $ per mile. For a full schedule of per diem rates by month and year for these areas, click on any of the minnesota.

Prepare an reimbursement request (docx) (um 1911) within 60 days of the expense date or trip return date.

Wv Mileage Reimbursement Form With Attestation Fillable Printable, Business rate $ per mile. The standard mileage rate for the business use of employees' vehicles will be 67 cents per mile , up 1.5 cents from the midyear rate set.

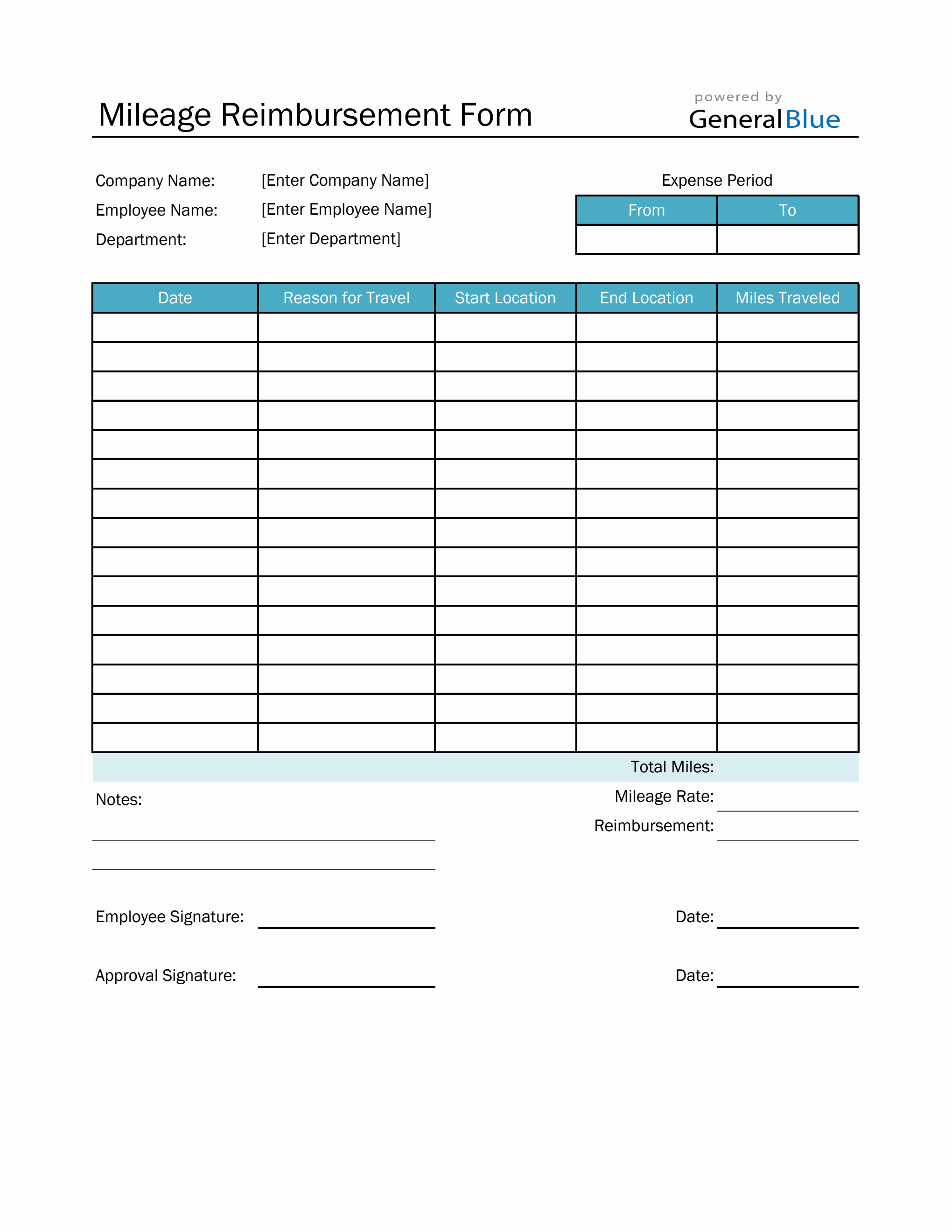

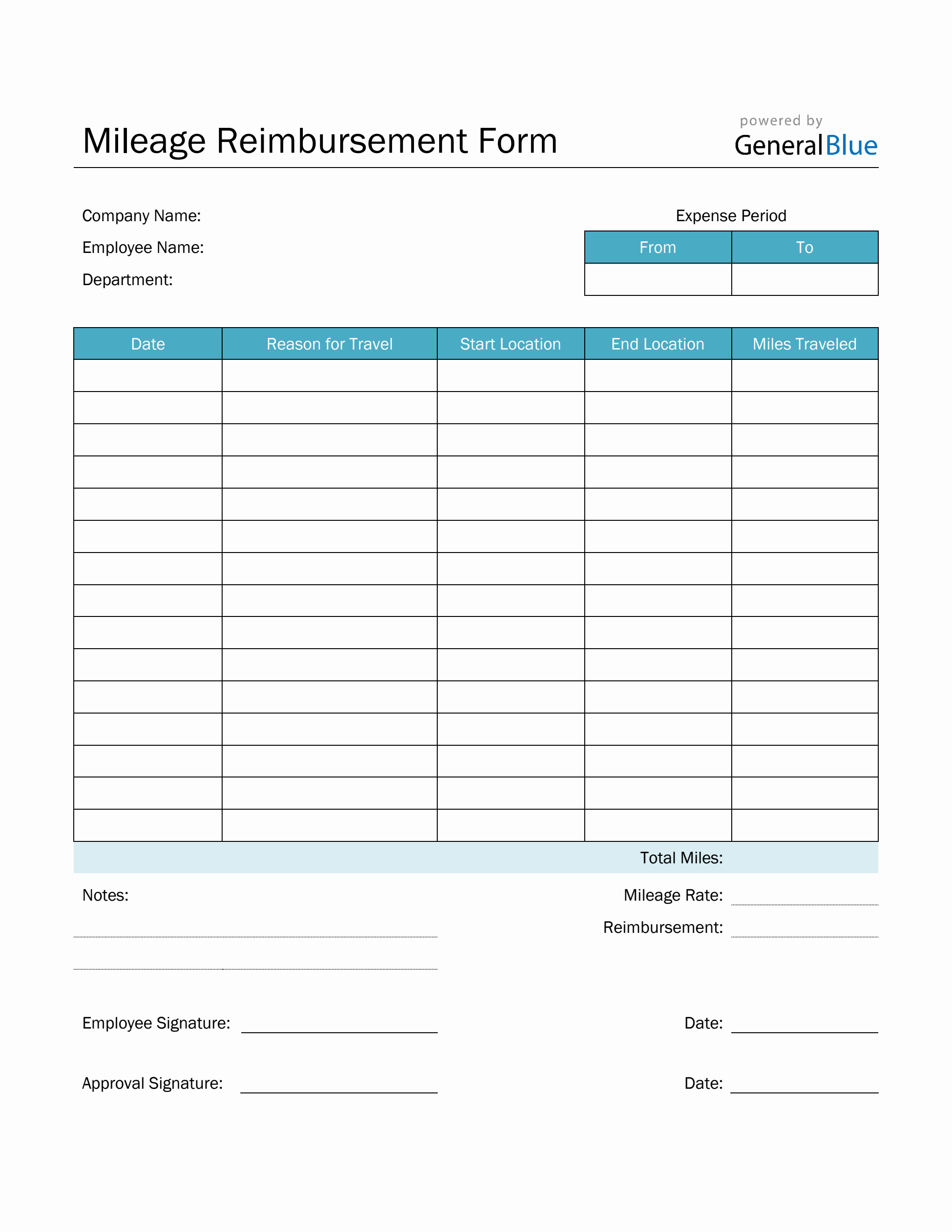

Mileage Reimbursement Form in Excel (Basic), 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own. 67 cents per mile driven for business use,.

Medical Mile Reimbursement After Minnesota Work Injury Maplewood, (irs mileage reimbursement will be provided) must be able to read a road map and a building floor. Miles driven in 2025 for medical.

Mileage Reimbursement Form in Word (Basic), $0.69 april 1, 2025, rate including quarterly fuel adjustment **ruca. Alternatively, i can use my own car with irs mileage reimbursement (2025 rate:

Canada Kilometer Reimbursement 2025 Cati Mattie, The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents per mile for moving or. 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own.

New Mileage Reimbursement Rate Effective July 1, The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents per mile for moving or. Obtain authorized signature (normally the.

Printable Mileage Reimbursement Form Printable Form 2025, Travelers may request reimbursement for domestic or international mileage using the irs standard mileage rate. The per diem rates shown here for lodging and m&ie are the exact rates set by the gsa for.

New Mileage Rate Method Announced Generate Accounting, Travelers may request reimbursement for domestic or international mileage using the irs standard mileage rate. The internal revenue service (irs) has announced a.

Minnesota's Statutes Regarding Mileage Reimbursement in Minnesota, For a full schedule of per diem rates by month and year for these areas, click on any of the minnesota. Click county for rate sheet.

California Mileage Rate 2025 Calculator Goldy Karissa, 21 cents per mile driven for medical. Valid minnesota driver’s license and clean driving record.